Doing trending Instagram challenges is one of the best ways of looking cool and trendy and going viral on the platform. So, if you’re looking for ways to gain more followers on Instagram & increasing your engagement, then you must read this article till the end. Because here you’ll be able to discover all the trending Instagram challenges, pick a challenge that suits you the best and do it ASAP!

Table of Contents

50+ Trending Instagram Challenges | Get Viral With The Latest Instagram Challenge!

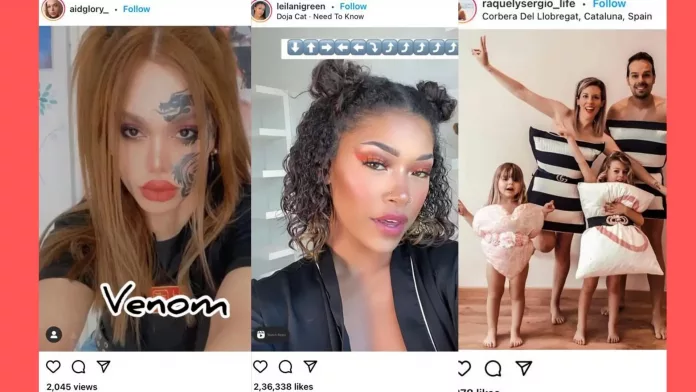

Plenty of challenges on Instagram are in trend right now. Some of them are new, some of them started around 2020-21, but are still relevant and popular, for example the Venom challenge, Don’t rush Challenge, the hit transition challenge, GRWMs, Dalgona coffee (except now it’s called whipped coffee)

Trending Instagram Challenges List For 2023

Here are some trending Instagram challenges of 2023 that you can try out to go viral on the platform!

Lockdown Glowup

In the lockdown glowup challenge, people make a video talking about how different they are in 2023 as compared to what they were earlier. Usually, people tend to glamorize and glorify their journey. But, this trend is here to tell people to be softer because not everybody was focused on building themselves, their business, or losing weight, etc. Some people were busy trying just to survive that difficult phase.

Dear Diary

In the “Dear Diary” challenge, people share a video showing everyone the source of their happiness, i.e. their male partner. In the beginning of the trend, people used to show-off their partners and tell people how happy they have been ever since this person came into their lives. However, the trend has now evolved and people tend to share anything that has made them a happier and better person. It could be self love, their friend group, etc. Yes, the dear diary trend is more wholesome now!

You Got This

“You Got This” is one of those trending Instagram challenges that motivates people to go one despite being tired in life. People make videos depicting their hard and sad time, yet working through it all. Videos on this challenge are here to inspire people to never give up on themselves or their purpose.

Lonely Challenge

The Lonely challenge is one of the most hilarious challenges on Instagram right now. To do this challenge, people compare themselves to random objects, cartoon characters, movie stars, etc. For example, “five signs you’re an onion”, and those signs would be something like- you’ve many layers, you make people cry, you can survive in harsh conditions, you can make everything taste better, etc. The comparison is usually downward but it is for humorous purposes.

Dumb Bitch

Can we please take a moment to appreciate the audio of the “dumb bitch” challenge. In this one, people make a video showing how they made a dumb decision and the trouble it landed them into. Again, this challenge is for humorous purposes.

A Day In My Life

“A Day in my life” are one of the most trending Instagram challenges and will always be. In this challenge, the video creator, walks their audience through a day in their life. They show their daily routine, everything they do, etc. For some reasons, viewers find these videos very engaging and even comforting! However, in the recent times, people have also started to make “a day in my life” video parodies to make fun of/ criticize some influencers who exaggerate and sugarcoat their daily routines!

Slay….Slay!

“Slay..Slay!” isn’t particularly one of the latest challenges on Instagram, but it is still very popular. In this one, people show how their minds and brains are different and ask them to do different things as well. For example, your mind will ask you to study for a test tomorrow, but your heart will ask you to just sleep.

Me… Obsessed With You?

“Me…obsessed with you? Of course I am”. In this challenge, people share a video or photo of something that other people think they are obsessed with. The viewer thinks that the creator is going to deny being obsessed with that thing. But, in a climatic twist, the creator says “of course I am”.

Skip, Skip, Skip

“Skip, skip, skip” is used to make fun or describe preferences or obsessions of users. These videos show a person rejecting everything, regardless of how nice those things are in favor of that one thing they can’t get enough of. And, believe me, these videos are HILARIOUS.

Die For You To Heartless

In the “die for you to heartless” challenge, people basically share their transformation photos and videos. They show their former selves- plain and boring, and how they would probably die for their partner or crush if asked for. Then, because their love story goes awry, they show how they are transformed to someone uber cool and hot. The new version of them shows how they are not going to give a shit about that person.

Ignore The Haters

“Ignore the haters” challenge is there to ask people to not listen to the outside noise or anybody who tells them that they can’t achieve their goals. It basically motivates the viewers to keep going on regardless of what the other person says.

One Kiss

One kiss is yet another hilarious challenge on the gram. In this one, a boy can be seen in front of the camera, while some media plays in the background. The boy is enjoying the scene, but then it changes to show how the boy didn’t like the change.

Don’t Panic Darling

In “don’t panic darling” the video creator urges the viewers to continue their journey without worrying about anything that comes in between. In some videos, people also share tips and resources that will help the viewers with a certain thing, for example, study tips for those finding it difficult to concentrate.

Conversations With The Old Me

“Conversations with the old me” is one of the most endearing Instagram challenges ever. In this one, people post pictures and videos of their younger self asking their former versions questions. These questions are answered by their older and current selves. The aim of this challenge is to show people how far they have come in life, and how different they are as compared to what they were before.

Don’t Rush Challenge

Don’t Rush is one of the most trending Instagram challenges currently, which demands a lot of coordination between you and your partner. You can also add some fun instagram trending steps from your end to do this challenge and make a new viral trend out of it.

The Transition Challenge

Transitions have always been a game-changer in the world of Instagram, and they will continue to flourish in the name of Instagram trends for a long time. You can do this trending Instagram challenge in any way you want, from a makeup transition video to a recipe transition video.

You can post the video with the #transition on your Instagram feed and serve your audience with some great transition content.

Come Here Girl Challenge

Come Here Girl or the sexy back dance challenge is by far one of the coolest Instagram trends with dance and twerking in full swing. All you need to do is gather a bunch of your besties and get started in front of the camera.

Let’s Dance Challenge

The next trending Instagram challenge to try is the Let’s dance challenge. You don’t need any routine for this Challenge. Get on your feet and copy the steps that the other person has done in the video. You can also add more fun steps to the Challenge and forward it to your friends to try.

Hand Gesture Challenge

Hand Gesture may seem like an easy challenge, but it’s very tough when you have to copy the hand gestures shown for fifteen seconds. Many creators do this challenge while others take some time to master this trending Instagram challenge.

Watermelon Sugar Challenge

Watermelon Sugar is a sweet Instagram challenge that most parents are posting on their Instagram accounts with their kids. In this Challenge, parents post a video of their kids portraying a younger version of their mom and dad.

Pillow Challenge

In the Pillow Instagram challenge, idea is to show the world your inner diva by pulling off a dress made from a pillow. Yes, you heard that right. In this trending Instagram challenge trend, you have to use your pillow to make a dress.

Celeb Look Challenge

Celeb Look Instagram’s challenge is for business accounts, especially those that deal with makeup products. They create a look of their favorite celebrity with the products and post it on their profile under the trending hashtag related to the challenge.

One Hand Workout Challenge

One Hand Workout Instagram challenge is for all workout enthusiasts. They need to bring out their workout mat, wear the gear, and get ready to do some workout, but the twist is that you have to do the exercises on two hands only. This is by far one of the coolest trending Instagram challenges we have seen.

Venom Challenge

Venom challenge has been spreading like wildfire on Instagram since July. The challenge isn’t as easy as you think. The person has to say the word Venom out loud in front of the camera. However, the twist is that you can’t play the song, but you have to remember when and where it comes and say it is at that exact moment. Don’t forget to add the song while editing as your audience needs to know how well you have performed the challenge.

The Pinky Finger Challenge

Pinky Finger is the easiest challenge to perform where you play the music of this challenge and start to count the beats on your fingers. All you have to find out is if it’s the middle finger or the pinky (little) finger when the music ends. Do this challenge today and see how your peers react.

West Side Killer

In the West Side Killer Instagram challenge, you have to do the steps with the lyrics of this song and see how well you can perform the hook steps of this challenge. Try the fun challenge and let us know if you were able to keep your two fingers apart.

Poof be Gone

Poof be Gone is such a fun song with killer dance steps to perform with your friends in front of the camera. Several content creators have added their own steps to this challenge and made it a hit. If you also have dancing feet, add your charm to this challenge and post it on your feed.

The Jeffrey Bezos Challenge

You all must have heard the Jeffrey Bezos song going viral on Instagram and TikTok. The Challenge behind this video is to introduce yourself with the lyrics of the song. You can also introduce your pets or your friends and family members using this sound. This is one of our favorite trending Instagram challenges.

Acting Challenge

The acting challenge is also a fun Instagram challenge to perform where you have to show how quickly you can shift from one emotion to the other. Some creators have taken a fun take on this challenge and are showing how they would act hilariously in different situations.

Emoji Makeup Challenge

You can choose any random number of emojis you like and show your makeup skills by drawing them on your face. You don’t need to paint the emojis literally but you can take inspiration from them for Emoji Makeup Challenge.

Got Me Good Challenge

Have you ever been in a situation where you are doing the same thing in two different circumstances that are entirely different? That’s what you have to do in Got Me Good challenge. Show how you would react while doing the signature step of the dance in different situations.

Hide & Seek Challenge

Hide & Seek is another fun Instagram challenge where you will set the timer for a few seconds on your camera and try to hide. If you get caught in the picture when the timer ends, you will lose. The challenge is more fun to do with your dog or any other pet you have. Wish we could have more of such fun trending Instagram challenges to perform.

Peaches Challenge

Peaches is another fun dance challenge for all the dancers out there. Play the song and groove to the beats of “I got my peaches out in Georgia.” Don’t forget to put your best dance foot forward. You can also ask your friends to do this challenge with you.

Dinero Challenge

If you log in to your Instagram account, you will see dance reels with this sound coming on your feed after every two to three posts. Dinero is one of the coolest Instagram challenges by far and the song will force you to dance your heart out even if you don’t wish to do so.

Can You Pay My Bills Challenge

Pay My Bills challenge is for all the people like you out there who are grateful to have someone in their life. You can show the undying love that you have for your partner with this sound. All you need to do is perform the hook step of this challenge along and add why you are grateful to have your partner while editing the video.

Phone Ya Challenge

Phone Ya Challenge is another fun transition video that you can shoot for your profile. Perform the hook step of this challenge on the beats of Give me your number so I can phone ya and add the next shot of your transition right when the beat ends.

Bundles Challenge

Bundles is another dance challenge that you can do with your friends or cousins. All you need is some practice of the dance steps so you can ace this challenge for your Instagram audience.

Need to Know Challenge

Need to Know is by far one of the most trending Instagram challenges that you can find on this list. You don’t have to do anything except move your camera in the directions shown in any other content creator’s video. If you don’t want to copy other’s styles, you can choose the directions as per your choice.

Ted Talk Filter Challenge

The last Instagram challenge on our list is the Ted Talk challenge. You can create the video with a fun or a serious aspect, by assuming that you are speaking at a Ted Talk event. Content creators around the world have used this filter to spread awareness about a lot of things.

More Trending Instagram Challenges 2022 That You Must Try In 2023 As Well!

#1 Kachcha Badam Song Challenge

#2 Reliving Childhood Memories

#3 Fashion Instagram Challenge

#4 Bingo Instagram Challenge

#6 Mugshot Instagram Challenge

#7 Saree Challenge

#8 Follow Me To Instagram Challenge

#9 Safe Hands Challenge

#10 Linkedin-Facebook-Instagram-Tinder Challenge

#11 The 100 Day Project Challenge

#12 Throwback Thursday Challenge

#13 365 Grateful Project Challenge

#14 Monday Funday Challenge

Final Words:

Okay, people! These were some trending Instagram challenges that you can perform to go viral! Pick any challenge that you think is fun and easy to do, make a video, and post it on your Instagram account! In case there’s some other challenge that you’d want to know the details of, mention it in the comments below and I’ll cover it for you ASAP!

What is the latest Marketing trend on Instagram 2022?

The latest Marketing trends on Instagram in 2022 are-

1. Relatable Influencers

2. More Live Content.

3. In-App Shopping.

4. Cause Marketing

5. Focus on Instagram Video

6. Trending Cross-Platform Content

7. Branded AR Effects

8. The Explore Tab

What content performs best on Instagram 2022?

If you want to make your Instagram trendy in 2022, you can go for the following trendy content.

1. You can post and use Videos, Stories,and Effects to make your content attractive.

2. You can do live streaming with followers and friends.

3. Use lots of attractive fonts to post on the carousel and design your Instagram page.

4. Collab with micro-influencers.

5. Use your account as a shopping platform, promotions, etc.

How do you find new challenges on Instagram?

If you are wondering what’s a new challenge on IG nowadays, find the latest trends on trends.google.com. Then go to the search option and search for terms like “Instagram,” “Instagram challenge,” or “Instagram trend.” You can adjust time periods to find the challenges that are a few days old or a few months old. You can now read the related queries to know about the most-searched Instagram challenges.

Who is the highest-paid Instagrammer?

Christiano Ronaldo is the highest-paid Instagrammer right now. He earns an average of $2.3 million per post.

What is the highest hashtag on Instagram?

The most used hashtags on Instagram are- #love (1.835 billion times), #instagood (1.150 billion times), #fashion (812.7 million times), #photooftheday (797.3 million times), #beautiful (661.0 million times), #art (649.9 million times), #photography (583.1 million times), and #happy (578.8 million times)